Contents:

Whether you are a beginner or an experienced investor, Questrade offers a bunch of features that distinguish it from other online brokers. Getting started with Questrade is a breeze thanks to no annual fees and a minimum investment of just $1,000. Automatic deposits are easy to set up, and when you move an investment account from another brokerage, Questrade will reimburse transfer fees up to $150 per account. Overall, the platforms are intuitive and easy to navigate. Questrade clients can trade on two desktop trading platforms or the mobile app.

Good customer service won’t be enough to save them from bad business practices and glitchy programming. For a discount broker that you can trust, Questrade is your best bet– Canada’s largest independent online brokerage. Read our Questrade review for the full details on why it’s the best trading platform. It offers a great balance of platforms, range of markets to trade and services including multiple account types. Questrade is an excellent choice if you reside in Canada or for international clients looking to trade Canadian and U.S. regional stock exchanges. I’ve been investing with Questrade for a few years now and am more than satisfied with all of the investing options and fees as you have pointed out.

And the fact that Questrade won’t charge fees on your RRSP, RRIF, or Tax-Free Savings Account is another big bonus. You don’t need to worry about achieving and maintaining a high balance to save on fees. Overall, https://broker-review.org/ Questrade has an offering that’s pretty tough to beat. It’s no surprise that it remains our top discount brokerage here at RetireHappy. Here at RetireHappy, our top pick continues to be Questrade.

For those who trade multiple markets, trading from two platforms might be cumbersome. For forex traders, the platform is intuitive, customizable, and offers advanced charting and access to more than 110 currency pairs as well as several CFDs. Getting started with a new account is relatively simple. New customers can sign up for a new account on the Questrade website, and go through a few videos that offer guides to the various available platforms. If you’re transferring an account from another brokerage or bank, Questrade will rebate up to $150 in transfer fees. If you trade mainly mutual funds and want to take advantage of dollar cost averaging, Questrade is not the place to be.

What about the minimum deposit?

Can you transfer funds out of your registered pension plan and invest them yourself to reduce investment fees? They purposefully lie and hide fees that incur overtime. Had this happen on 20k LOSSES they were charging interest on for 2 years. Over4k USD interest charged in 2 years, and the only way to see this money owed and interest accruing is deep in pages that you would not visit on your day to day trades.

It’s one of the only brokerages that allows you hold both CAD and USD inside of the same account. The only service we’d like to see added to the Questrade range is cryptocurrency trading. Judging by its offer to date, we’re certain they will become one of the best crypto exchanges in Canada. Other than that, Questrade is a top-notch brokerage firm that we can wholeheartedly recommend. All three paid plans have rebate options, with the Enhanced Market Data plan having only a partial rebate and the Advanced plans having a full one.

When I checked in to see how much my little account had grown, they had pilfered 400 dollars in inactivity fees. In attempting to resolve this, they made further promises that they then did not fulfil. ITrade does offer some commission-free ETFs, but if you’re looking to buy stocks, then it’s $9.99 per trade. One fee you didn’t mention is that of ECN fees which often occur on any Questrade order, whether stocks, or free ETF buys. These fees can be avoided if you know and follow the rules, but understanding when they will or will not be charged can be difficult for inexperienced DIY’ers.

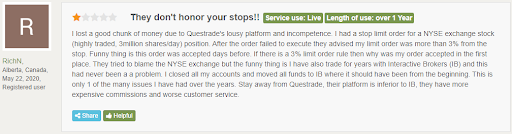

They’ve had significant outages affecting their client’s ability to trade. There’s also unsettling reports of them aggressively pursuing legal action to anyone who attempts to post negative experiences online. As previously mentioned, DIYers with small portfolios (under $1,000) could get dinged with a hefty fee each quarter if they aren’t making transactions regularly. Clients can also access the latest market information for free, thanks to a news feed Powered by Bezinga. It goes against our guidelines to offer incentives for reviews.

If you’re the type of investor who wants to engage in forex trading – and we’re not suggesting that you are – then you should ask yourself if Questrade is the right platform for this activity. The top competitor to Questrade in the forex broker space is Interactive Brokers. Here’s another example of what a watch list might look like with the Questrade trading platform. I like the colours since the red and green help you discern/ visualize how the stocks that you are watching are doing more easily.

How they manage to survive is beyond my comprehension. What a crock of crap and I will now look at transfering to another broker, as their customer support is non existant and very unprofessional. Went to place a day trade today in premarket as the stock was ascending and my trade was questrade review listed as pending for over 60 seconds and I did not have the option to cancel the order. I’ve spent over 20 hours on holds to get a simple transfer complete. They told me it would no problem, but it didnt’ work. The third time, on hold for 3.5 hours, they said they refused to do it.

Questwealth Portfolios

Bonds are relatively similar to GICs, except instead of lending money to banks, investors lend their money to various levels of government or corporations. Once the bond’s term is complete, the investment is returned, with additional interest. They’re also a safe way to increase the overall yield of a portfolio. The cost of the bond varies and depends on its purchasing price.

- The layout is easy on the eyes and easy to navigate.

- While the platforms are similar in overall functionality, IQ Edge has a deeper offering of trading tools and customization and is certainly the preferred platform for active traders.

- I believe the best trading platform in Canada for advanced traders is Questrade.

- Trading software facilitates the trading and analysis of financial products, such as stocks or currencies.

- Tried to open a joint margin/cash/non registered account and the amount of paperwork required to move money INTO the stupid accounts caused me to close the accounts.

It’s worth noting that the paid market data subscriptions are refundable; if your total commissions for the month total $48.95 or more, you’ll receive a $19.95 rebate. In 1999, at the dawn of online stock trading, entrepreneur Edward Kholodenko co-founded Questrade with three partners. Based in Toronto, their aim was, and remains, to offer DIY investors a low-cost alternative to Canada’s large banks and brokerages. Weathering the dot-com crash that soon followed, Questrade emerged to become the country’s fastest growing online brokerage. There are fees for access to advanced market data packages. However, these fees can be waived if you qualify as an active trader.

Market Data Packages

Customers who generate more than $48.95 in monthly commissions receive a $19.95 rebate on the package fees. A full rebate on package fees is credited when a customer generates $399.95 in commissions in a month. The mobile app is essentially the same experience as the web version, scaled to fit the device. Questrade screeners are limited to an extremely simple stock and options screener. For the StockBrokers.com 13th Annual Review published in January 2023, a total of 3,332 data points were collected over three months and used to score 17 top brokers. This makes StockBrokers.com home to the largest independent database on the web covering the online broker industry.

If they want to be professional, they have some more work to do. I tried opening a corporate account for over 1 week. Once I fixed the 1st issue then another issue was not correct and they would e-mail again.

Transfer Fee Rebate

In terms of charting, you’ll want to download Questrade’s IQ Edge platform, which we will go over next. Questrade goes a step further and uses a two strikes and you’re out system. If you enter a password incorrectly twice, you’ll be forced to call customer service to recover your account.

regular problem slow and ca’t log into my account

We also compared Questrade’s fees with those of two similar brokers we selected, Qtrade and RBC Direct Investing. This selection is based on objective factors such as products offered, client profile, fee structure, etc. See a more detailed rundown of Questrade alternatives.

After moving your assets, you can call Questrade’s customer service and ask them to close your account. Questrade, Inc. is a registered investment dealer, and Questrade Wealth Management Inc. is a registered Portfolio Manager, exempt market dealer, and investment fund manager. This is a savings of up to $10 each time you buy ETFs on the platform. On the trading platform front, Questrade stands out among the competition, with many options to choose from.

Likewise, for trading options, the cost is $6.95 + $0.75 per contract or $4.95 + $0.75 per contract . Questrade provides transparent pricing with commission-free ETF trades and discounts available for active traders, with no annual fees. I’d like to see a more in depth review that is less like an advertisement that paints one platform as a fee pirate and the other like a cure-all . I do use a full service broker for their advanced trading platform, which is great for anyone that uses technical analysis or wants to view price action.